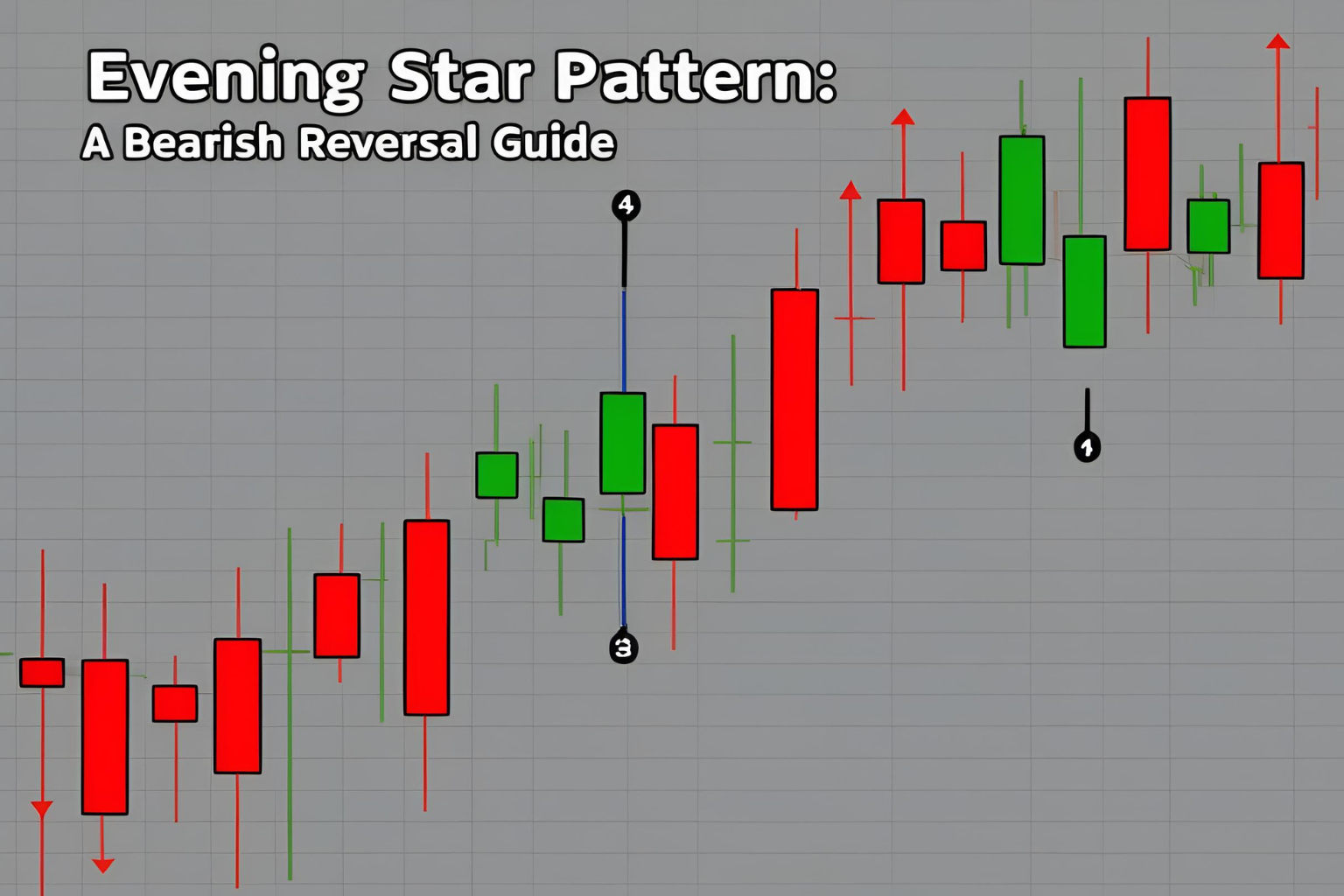

Evening Star Pattern: A Bearish Reversal Guide

The Evening Star candlestick pattern is one of the most reliable bearish reversal signals in technical analysis. For beginners learning candlestick charts, understanding this pattern can help you spot potential market tops and exit before a trend reverses.

This guide explains what the Evening Star is, how to identify it, and how traders use it in stock, forex, and crypto markets.

What Is the Evening Star Pattern?

The Evening Star is a three-candle pattern that forms at the top of an uptrend and signals a possible bearish reversal.

It consists of:

- A large bullish candle (strong upward move)

- A small-bodied candle (indecision, often a doji or spinning top)

- A large bearish candle (confirms the reversal)

This sequence shows the weakening of buying pressure and the rise of sellers.

Visual Example

Here’s a simplified breakdown:

sqlCopyEditDay 1: Large Green Candle

Day 2: Small Candle (gap up, indecision)

Day 3: Large Red Candle closing below the midpoint of Day 1

This structure resembles a star in the sky fading out — hence the name “Evening Star.”

How to Identify the Evening Star Pattern

Use this simple checklist:

- The pattern appears after an uptrend

- The first candle is strong and bullish

- The second candle gaps up and is small (shows hesitation)

- The third candle is bearish and closes well into the body of the first

Volume can also help: higher volume on the third candle strengthens the pattern.

Why Is the Evening Star Important?

The Evening Star helps traders:

- Exit long positions near a possible top

- Enter short trades with confirmation of weakness

- Manage risk using nearby stop-loss levels

It’s commonly seen before major trend reversals, especially when combined with resistance zones or overbought indicators like RSI.

How to Trade the Evening Star Pattern

Here’s a step-by-step approach:

- Wait for the pattern to complete – Don’t act until all three candles are formed.

- Confirm with other indicators – RSI divergence, resistance zone, or moving average.

- Enter on the next candle – after the third (bearish) candle closes.

- Set a stop-loss above the high of the pattern.

- Target the nearest support level or use a risk-reward ratio like 1:2.

Common Mistakes to Avoid

- Entering before the pattern completes

- Ignoring the trend direction (this is a reversal pattern, not a continuation one)

- Trading without confirmation (volume or secondary signals)

FAQs

What does the Evening Star candlestick pattern indicate?

It signals a potential bearish reversal after an uptrend, warning traders that buying pressure is fading.

Is the Evening Star reliable?

Yes, especially on daily charts or higher timeframes and when supported by volume or resistance zones.

How is the Evening Star different from the Morning Star?

The Evening Star appears at the top of a trend (bearish), while the Morning Star appears at the bottom (bullish).

Can the Evening Star form in crypto charts?

Absolutely. The pattern works across all markets—stocks, forex, and crypto—because it reflects trader psychology.

What’s the best timeframe to spot the Evening Star?

The 1-hour, 4-hour, and daily timeframes tend to show the pattern more clearly and reliably.